Employment Law Trending Now – Illinois Employers Required to Provide Public Transit Benefits Beginning in 2024

10.25.23

On July 28, 2023, Illinois enacted the Transportation Benefits Program Act (the “Act”) which, starting January 1, 2024, requires Illinois employers to provide their full-time employees with pre-tax public transit benefits after 120 days of employment.

The Act applies to employers that:

1. Employ at least 50 full-time employees at an address within one mile of any transit service run by the Regional Transportation Authority

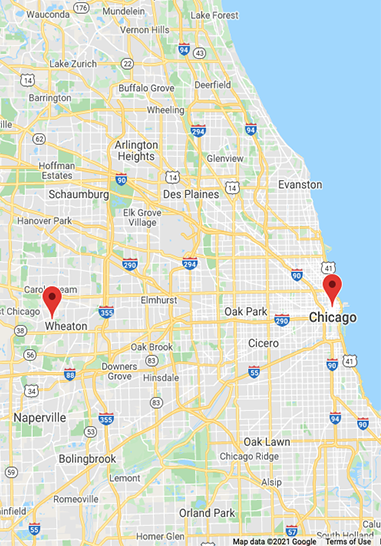

2. Are located in 38 specific Illinois counties and townships, including Cook County

Under the Act, eligible employees must be allowed to elect pre-tax compensation reductions to purchase transit fare. The transit benefit must satisfy the federal requirements and limitations for qualified transportation fringe benefits contained in Internal Revenue Code Section 132(f). The maximum amount of pre-tax compensation that can be used per month has not yet been published by the IRS. For reference, the maximum amount for 2023 is $300 per month. 2. Are located in 38 specific Illinois counties and townships, including Cook County

If you have any questions about this alert, whether the Act applies to your business or if you would like assistance in ensuring your company’s compliance with the Act, please reach out to Amy M. Gibson, Emma Sander or the Aronberg Goldgehn attorney with whom you normally work.

225 W. Washington St.Suite 2800Chicago, Illinois 60606

301 S. County Farm RoadSuite AWheaton, Illinois 60187