SEC Proposes New Rules Regulating Registered Investment Advisers' Use of Service Providers

10.28.22

David A. Johnson Jr.

Douglas C. Murray

Mark D. Anderson

Paul A. Gilman

Timothy R. Nelson

John C. Sciaccotta

Jordan Sharp

Douglas C. Murray

Mark D. Anderson

Paul A. Gilman

Timothy R. Nelson

John C. Sciaccotta

Jordan Sharp

The Securities and Exchange Commission (SEC) has proposed new rules under the Investment Advisers Act of 1940 that could impact registered investment advisers and providers of key outsourced services to advisers.

These proposed rules would establish a set of “minimum and consistent due diligence and monitoring obligations” for advisers’ use of third-party service providers prior to and during service providers’ engagements with the adviser.

The proposed rules would apply to “Covered Functions” performed by a service provider, which would include functions:

- necessary for the adviser to provide its investment advisory services in compliance with the federal securities laws; and

- those that, if not performed or performed negligently, would be reasonably likely to cause a material negative impact on the adviser’s clients or on the adviser’s ability to provide investment advisory services.

As part of its due diligence, an adviser would be required to consider several factors regarding the service provider, including competence, capacity, and the resources available to the service provider. An adviser would be required to create certain records related to their due diligence assessment. An adviser would also be required to disclose its service providers to the SEC, and would be required to monitor the service provider’s performance in a prescribed manner.

While these proposed rules should be reviewed by registered investment advisers, providers should also be aware of them. The proposed rules being promulgated under the Advisers Act are 17 CFR 275.206(4)-11 (“proposed rule 206(4)-11”) and amendments to 17 CFR 275.204-2 (rule 204-2) and Form ADV [17 CFR 279.1]. The proposed rules can be accessed at the SEC’s website by clicking here, which also provides the procedure to submit comments for the SEC to consider prior to adopting a final rule.

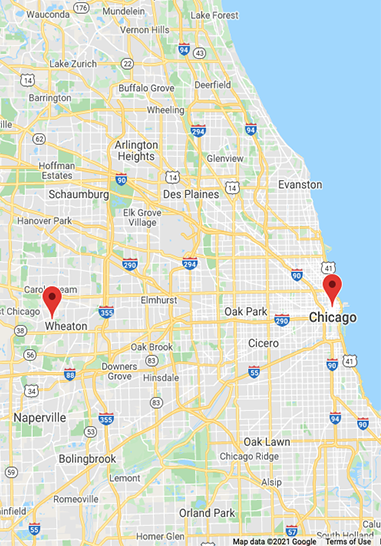

225 W. Washington St.Suite 2800Chicago, Illinois 60606

301 S. County Farm RoadSuite AWheaton, Illinois 60187